Fed rate hike

During his post-meeting conference Fed Chair Jerome Powell. By Ann Saphir and Howard Schneider.

Powell S Fed Rate Hike Plans Get Jolted By Inflation Eco Week Bnn Bloomberg

The central bank boosted its benchmark rate by 075 percentage point bringing the Feds target range to 375 to 4.

. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. In September the Federal Reserve raised rates by 75 basis points marking the fifth rate hike of the year. 5 1980 they hiked the target.

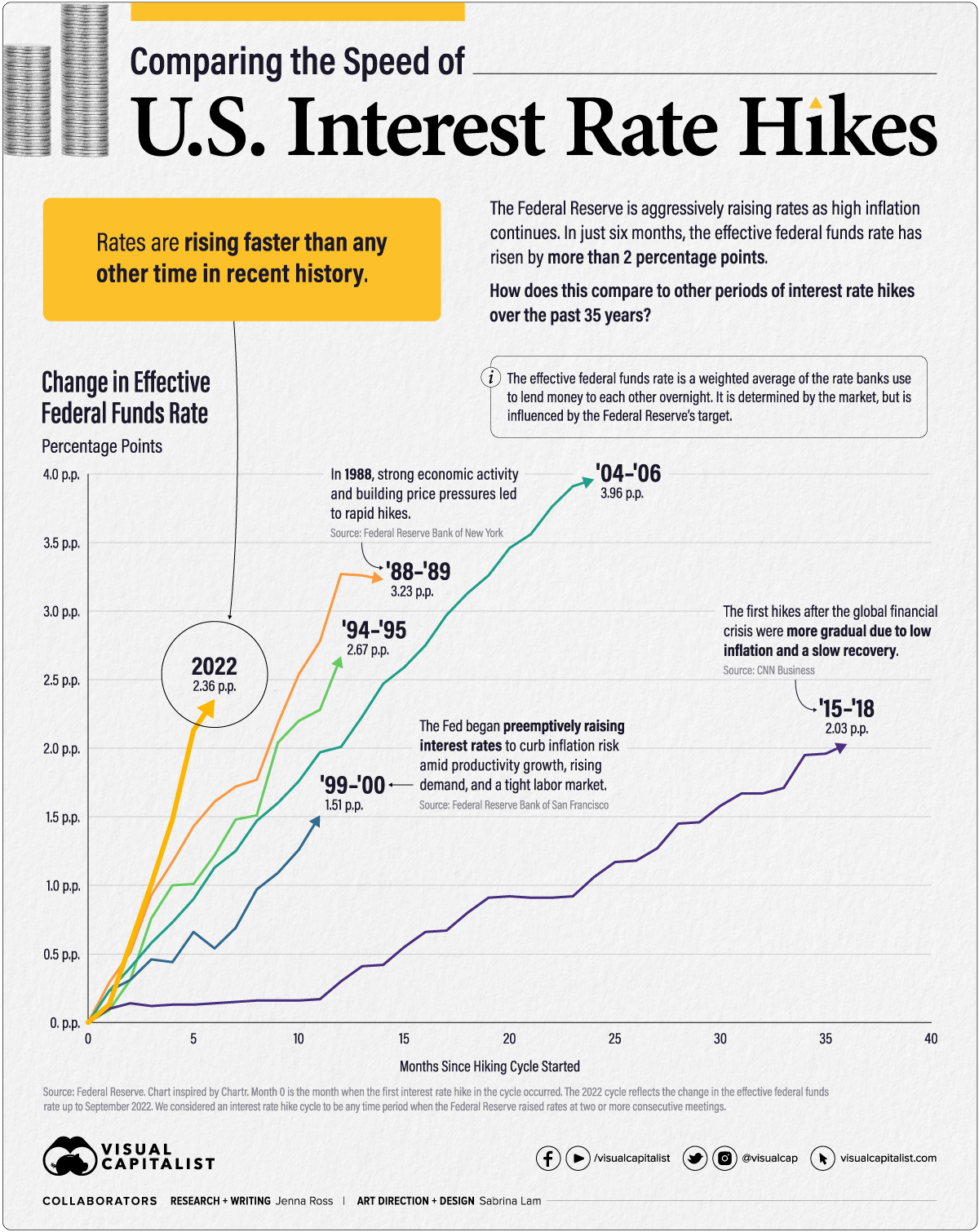

Ad Were Americas 1 Online Lender. Lock Your Rate Now With Quicken Loans. The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s.

21 hours agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. 1 day agoThe Federal Reserve raised interest rates by another 075 percentage points Wednesday as part of its ongoing effort to fight inflation. 19 hours agoThe Federal Reserve raised interest rates by another three-quarters of a percentage point taking its benchmark federal funds rate to a range of 375 to 4 in an effort.

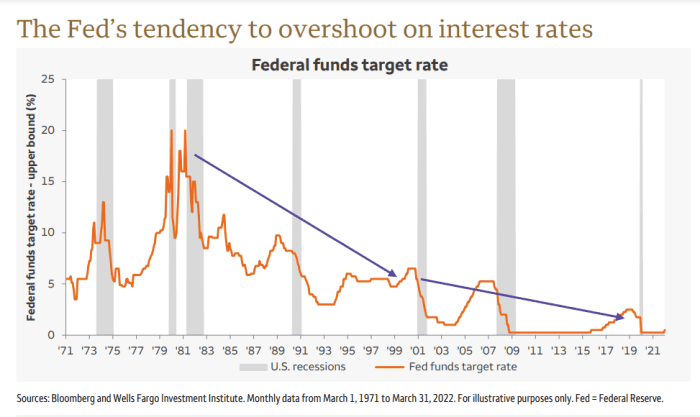

The Fed tried to cool off the economy and the growing real estate bubble by hiking interest rates 17 times in two years raising the fed fund target rate by 4 percentage points over. The fed funds rate began the decade at a target level of 14 percent in January 1980. The bank is moving at a level.

Ad View the Highest Interest Bank Accounts. 22 hours agoChanges to the Federal Reserves post-meeting statement along with another 075 percentage point interest rate hike Wednesday should be enough to indicate that the central. By the time officials concluded a conference call on Dec.

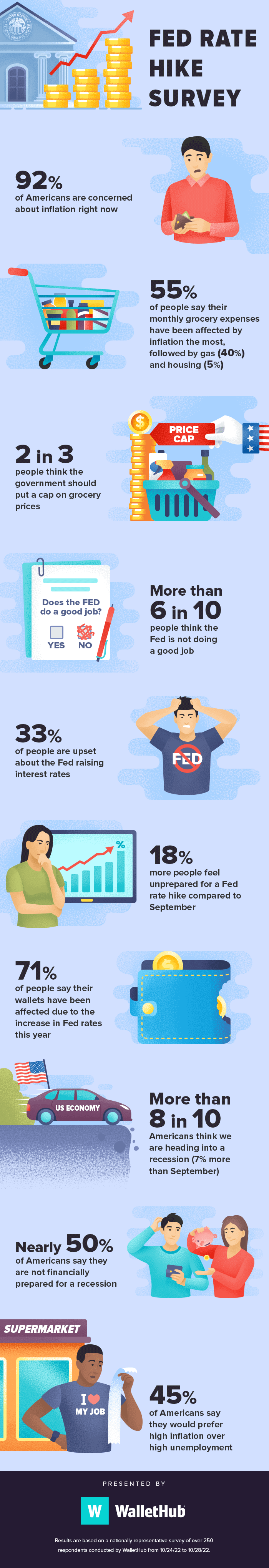

Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023. The Feds five hikes so far in 2022 have increased rates by a combined 3 percentage points or 300 in interest added on every 10000 in debt. The Fed has penciled in a terminal rate in the range of 45475.

Read The 1 Source For Breaking News Since 1892 Get Exclusive Dallas News Now. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. Rate hikes are associated with the peak of the economic cycle.

There is growing disagreement among economists about the peak or terminal rate of this hiking cycle. Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three. October 13 2022 954 AM 3 min read.

The central bank has been bedeviled by. 1 day agoWhat is the Fed rate hike. Adjustable-rate loans such as ARMs that.

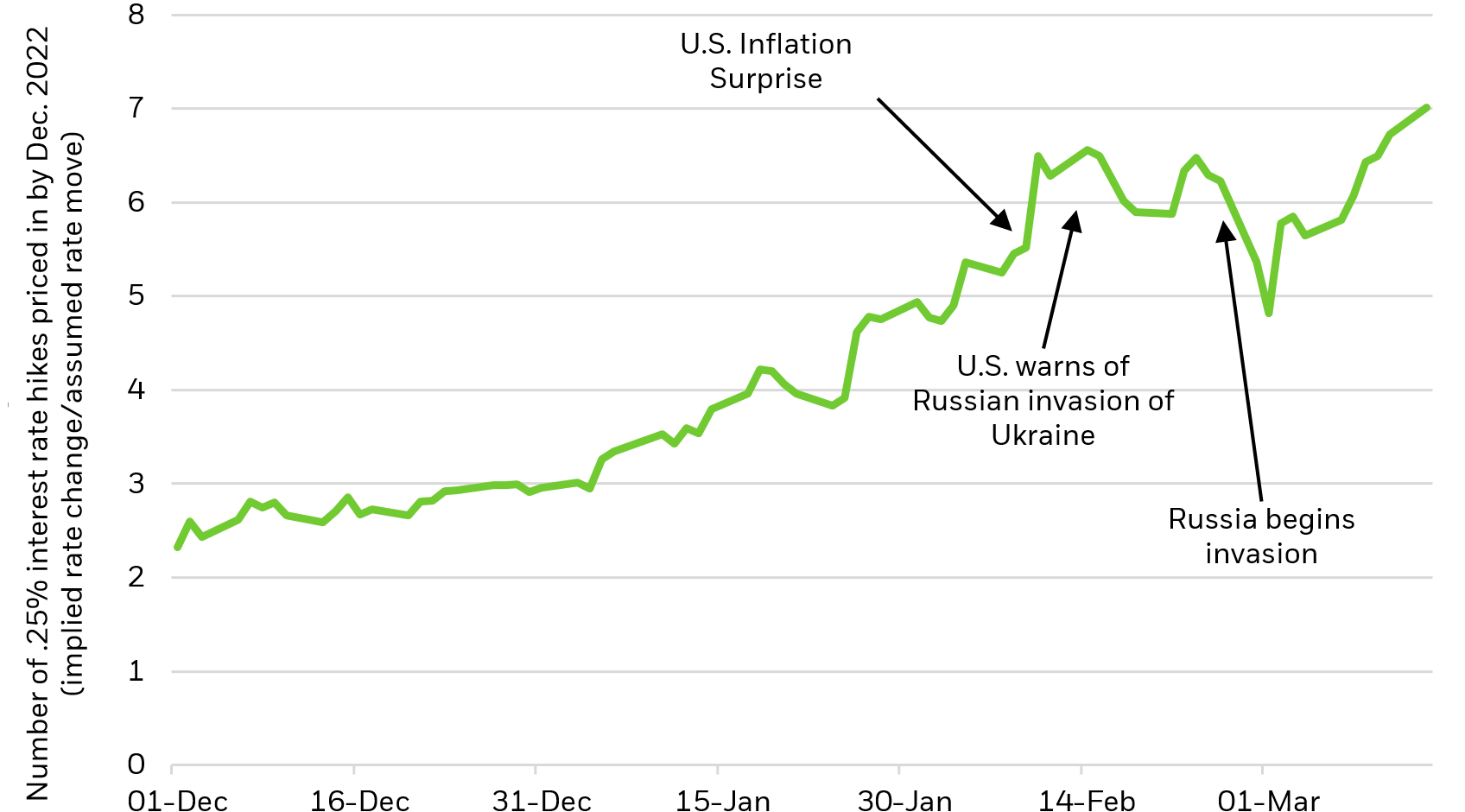

For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. Prices rose by a hotter-than-expected 83 in August while core inflation a measure that excludes volatile food and energy prices jumped by 63. Our Fed rate monitor calculator is based on CME Group 30-Day Fed Fund futures prices which tend to signal the markets expectations.

At the time the Fed indicated that it was unlikely to be the last rate. 1 day agoBusiness Oil falls as Fed rate hike raises fuel demand concerns article with image 836 AM UTC. Sterling slumps ahead of BoE decision after Fed hikes rates again.

Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov. The benchmark rate stood at 3-325 after starting from zero this. 1 day agoThe Fed has already hiked rates five times this year the last three at 075 percentage points which used to be considered unusually steep.

The Fed has increased rates from near zero in March to a target range of 3 to 325 the highest level since 2008 and the most aggressive pace since the 1980s. 0 Weeks 0 Days 22 Hours 29 Minutes. The Federal Open Markets Committee FOMC meeting on September 21 2022 ended with another 75-basis-point rate hike that brings the current Fed Funds Rate range to.

The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released. The big question is what happens next. That implies a quarter-point rate rise next year but.

What Does The Federal Reserve Interest Rate Hike Mean To You Bayntree Wealth Advisors

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Chart Federal Funds Rate Returns To Levels Last Seen In 2008 Statista

Us Fed Hikes Interest Rates For First Time Since 2018 Times Of India

Fed Chief Jerome Powell Pivots Toward 50 Bps Interest Rate Hikes Business Standard News

Maneuvering Through The Fed S Hiking Cycle Ishares Blackrock

Fed Raises Interest Rate Half A Percentage Point Largest Increase Since 2000 The New York Times

Interest Rate Hike What It Means Saskatoon Residential

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

Pmb3u3v5bgvjym

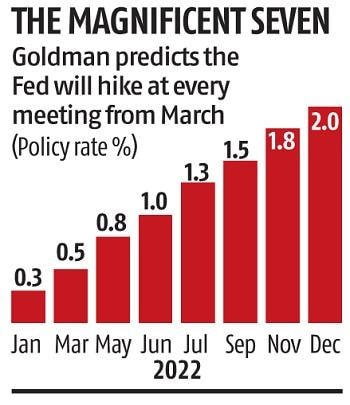

Now Goldman Expects 7 Us Federal Reserve Rate Hikes In 2022 Business Standard News

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Largest Interest Rate Hike In 22 Years How Will The Market React Propertylimbrothers

Y Dhlectu 6eim

Fed Swaps Fully Price Three Quarter Point Rate Hike In November Bnn Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/24042678/UzzuD_the_fed_has_been_raising_interest_rates_for_months.png)

The Fed Raised Interest Rates Again What Does That Mean For The Economy And Inflation Vox

Fed Boosts Rates For First Time In 4 Years